While politicians argue and campaign on “abolishing the IRS,” the agency is already taking action—seizing bank accounts, garnishing wages, and placing liens.

The IRS paused collections during the pandemic. That wasn’t mercy—it was a delay. Now, they’re back, more aggressive than ever.

The IRS has survived:

The bank accounts, homes, and businesses of people who waited for political promises.

The IRS doesn’t wait. Neither should you.

The IRS doesn’t care about your story, your mortgage, or your family. But we do.

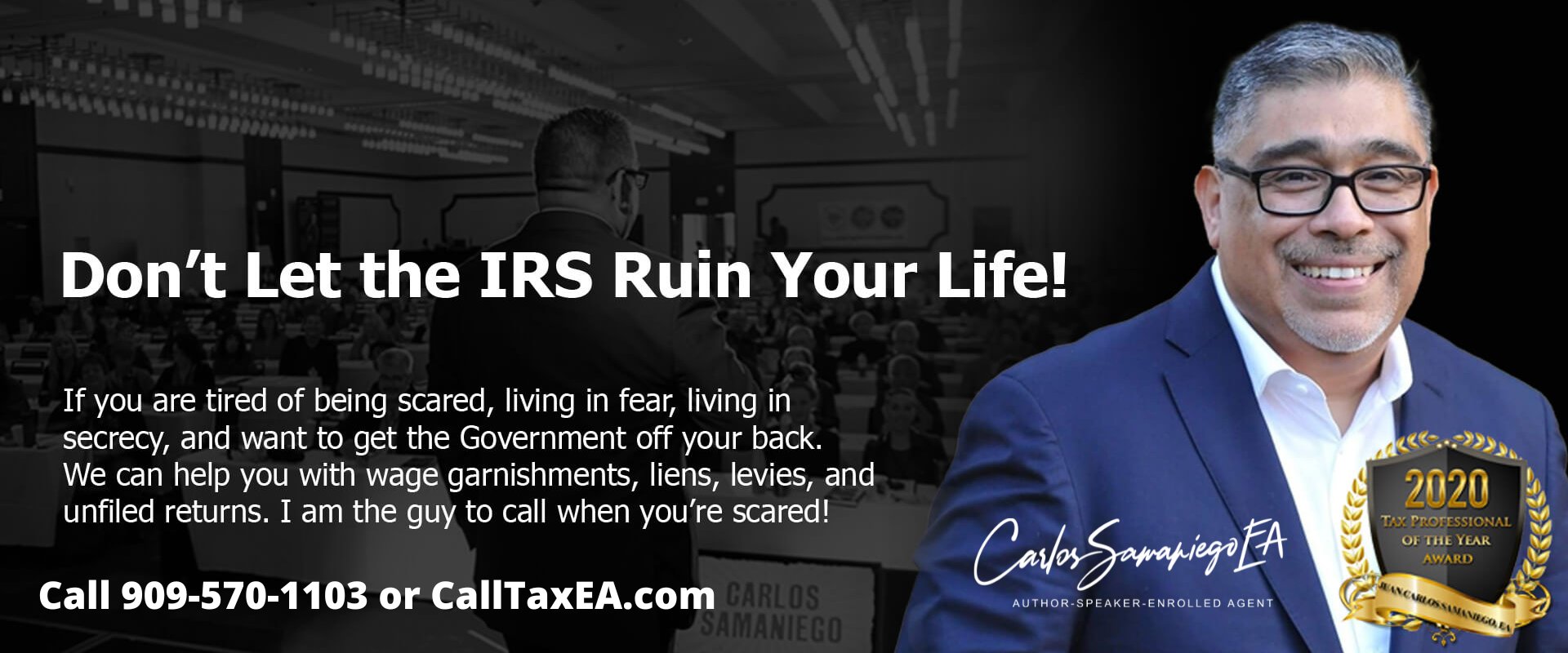

I know this system inside and out—because I was once a target myself. Today, I lead a team of tax professionals, former IRS insiders, and strategic advisors who know exactly how to fight back.

We don’t do empty promises. We deliver results.

for your FREE Tax Debt Analysis

While you're reading this, the IRS is already making their next move. Don't wait until it’s too late.

To Your Immediate Financial Freedom,

Carlos "The Tax Consigliere" Samaniego

The longer you wait, the harder it is to fight back.

“Carlos and his team saved my business when the IRS was about to shut me down!” – John M.

“They stopped my wage garnishment just days before payday. I don’t know what I would have done without them.” – Sarah L.

“I owed over $100K, and they negotiated it down to a fraction of that. Incredible!” – Robert D.

ESTATE TAX EMERGENCY ALERT

ESTATE TAX EMERGENCY ALERT

Did Someone You Love Pass Away and You Haven't Filed Their Estate Tax Returns?

If the estate generated more than $600 in income and you missed the April 15th deadline, you're facing 5% penalties per month that could cost you thousands.

Don't let the IRS destroy your family's legacy with brutal estate tax penalties.

GET IMMEDIATE HELP - ESTATE TAX EMERGENCY →

Call 909-570-1103 for Your Free Emergency Assessment

Our friendly and responsive staff takes the pain out of filing your back tax returns.

We specialize in all forms of tax problem resolution with an emphasis on IRS audit representation.

We have extensive experience mediating between taxpayers and the IRS.

We can work directly with the IRS to initiate a payment plan like an offer in compromise or installment agreement.

The IRS has started offering a special program to make it easier for taxpayers to get their tax liens released.

Attention: Business Owners, Entrepreneurs, Self-Employed: The IRS has made a huge initiative in 2020 to go after business owners who have: Unfiled tax returns, owe 941 payroll taxes, or have large balances due. The IRS can go after your vendors for past tax debt you may owe and you could lose your state license due to past due to tax debts