Yesterday, while most people were scrolling through their phones, 525,000 federal employees found something chilling in their mailboxes.

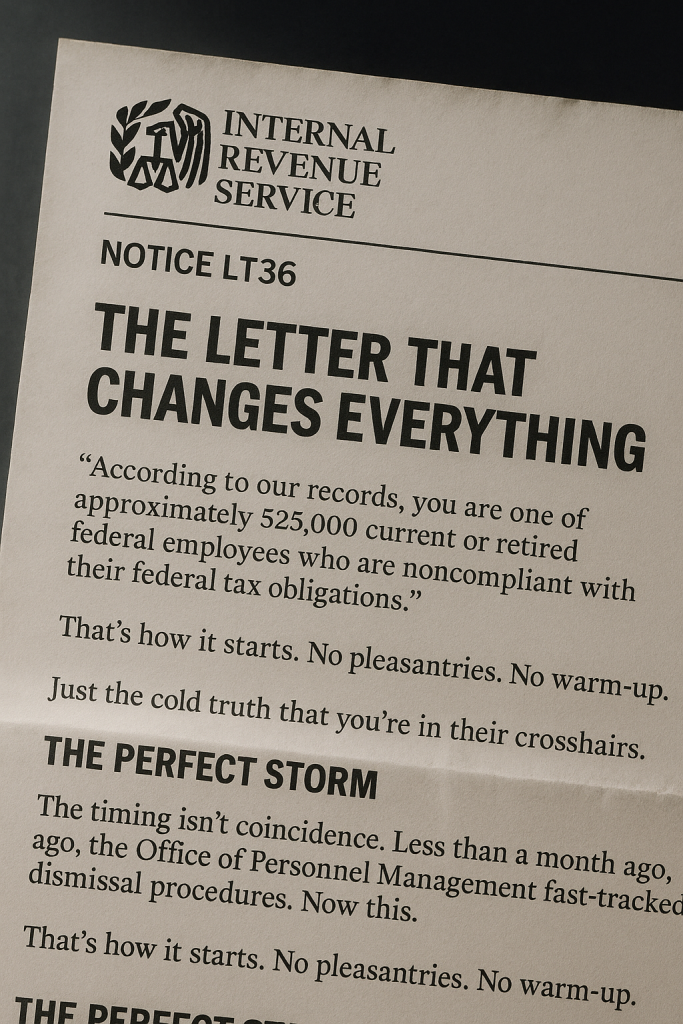

Notice LT36.

The IRS doesn't send friendly reminders. They send warnings.

The Letter That Changes Everything

"According to our records, you are one of approximately 525,000 current or retired federal employees who are noncompliant with respect to their federal tax obligations."

That's how it starts. No pleasantries. No warm-up. Just the cold truth that you're in their crosshairs.

I've seen this playbook before. During my 8-year nightmare with the IRS, I learned they don't bluff.

When they say "we will follow up with you directly," they mean it.

But here's what makes this different—and dangerous.

The Perfect Storm

The timing isn't coincidence. Less than a month ago, the Office of Personnel Management fast-tracked employee dismissal procedures. Now this.

As Jessica Marine, a former Tax Court attorney, told reporters: "It did concern me that this was going to be a bigger push, a stronger push to enforce this action against federal employees, up to and including termination."

Translation: They're not just coming for your paycheck anymore. They're coming for your job.

Remember The Collector from my stories? That agent who destroyed families with a signature? He's got 524,999 new targets.

Why Federal Employees Are Sitting Ducks

Here's what civilian taxpayers get that you don't:

Notice requirements

Hearing rights

Standard collection procedures

Here's what the IRS can do to federal employees:

Take 15% of your pay immediately

No hearings required

No advance notice needed

And now? Recommend termination.

It's like being a medic in a combat zone without body armor while everyone else gets full protection.

The Payment Plan Trap

Even employees already in payment plans received LT36 notices. Let that sink in.

You thought you were safe. You thought compliance meant protection.

The rules changed. The game escalated.

What Happens Next

I've walked federal employees through this minefield for years. Here's the reality:

The Wrong Move: Ignore it, hoping it goes away.

The Desperate Move: Call that number on the notice and beg.

The Smart Move: Get professional representation before you become another casualty.

This isn't about owing taxes anymore. It's about survival in a system that just declared war on federal workers.

Your Next Step

If you received LT36, you have two choices:

Fight this alone against an agency with unlimited resources and supercharged collection powers.

Or get someone in your corner who's survived their worst and knows how to win.

The Collector is counting on you to panic.

To make desperate moves. To negotiate from fear.

Don't give him the satisfaction.

[Schedule Your Emergency Tax Triage Call Here]

Some battles you can't fight alone. This is one of them.

Stay strong,

Carlos Samaniego, EA

The Tax Debt Detective™

P.S. - During my Army psych tech days, I learned that the first 72 hours after trauma determines everything. Consider this your trauma alert. The clock is ticking.