By Carlos Samaniego, EA – The Tax Debt Detective™

Every week, someone calls my office screaming the same thing:

They’re talking about what I call CaliClaw—California’s Franchise Tax Board (FTB). While most people think it’s just another government agency, I’ve seen what it really is: a financial predator that makes the IRS look like a friendly neighbor.

“Carlos! They garnished my wages out of nowhere! No warning! No notice! Nothing!”

After rescuing families from the Tax Underworld for over a decade, I’ve learned something that might shock you: CaliClaw always warns its prey before it strikes. The problem? Most people never see the warnings coming.

Today, I’m going to expose CaliClaw’s complete hunting system—from its methodical stalking patterns to its most devastating attacks. More importantly, I’ll show you how to defend yourself before it’s too late.

Meet CaliClaw: Why It’s More Dangerous Than the IRS

Let me paint you a picture. It’s 6 AM, Bruno and I are walking by the creek when Elizabeth texts me a screenshot from a panicked client:

“Carlos—they took $2,400 from my paycheck. Without warning. What do I do?”

That’s CaliClaw in action. It doesn’t knock on your door or call you up for a chat. It reaches directly into your employer’s payroll system and claws out 25% of your gross wages.

Every. Single. Month.

Until you’re paid in full.

The Critical Difference

- IRS: Sends multiple notices, offers payment plans, accepts negotiated settlements

- CaliClaw: Follows a kill sequence designed to drain your accounts before you can react

I’ve seen grown men cry when CaliClaw hits their paycheck. Watched marriages crack under the financial pressure. Seen kids ask their parents why there’s no money for groceries.

That’s what CaliClaw does. It doesn’t just take your money—it takes your dignity, your security, your peace of mind.

CaliClaw’s 4-Strike Kill Sequence: How the Beast Stalks Its Prey

See, CaliClaw isn’t some rogue predator striking randomly. It’s methodical. Systematic. Like a sniper who telegraphs every shot—but only if you’re watching the right target.

Here’s exactly how it hunts:

Strike 1: The “Friendly” Notice of Tax Due

CaliClaw sends what looks like a polite reminder. “Hey, you owe us money.” Most people think it’s junk mail or file it under “I’ll deal with this later.”

Big mistake. CaliClaw just marked your scent.

Strike 2: Demand for Payment

Temperature rises. The tone gets sharper. “Pay up or we escalate.” This is CaliClaw showing its claws, testing if you’ll run or fight.

Still think you can ignore it? CaliClaw’s patience is running thin.

Strike 3: Final Notice Before Levy

This is it. Your last warning before CaliClaw pounces. “We’re about to take your money whether you like it or not.”

Most people who call me crying about “no warning” got this letter. They just didn’t recognize it as a death threat to their paycheck.

Strike 4: The Kill Shot (Earnings Withholding Order)

Game over. CaliClaw sends the garnishment order directly to your employer. Your boss gets it. HR gets it. Your coworkers start whispering.

And you? You find out when your paycheck is $800 light.

The Real Danger: Each strike seems harmless by itself. But CaliClaw isn’t sending friendly reminders—it’s building a legal case for why it has the right to raid your paycheck.

The Address Trap: CaliClaw’s Favorite Hunting Ground

This is where it gets vicious—and where I see the most devastating attacks.

The Setup

Last month, Sarah* called me sobbing. “Carlos, they garnished my wages for $1,600. I swear I never got any letters!”

(*Client names changed to protect privacy)

Within two hours, I’d pulled her FTB transcripts. Sure enough—four notices. Mailed over six months. Each one sent to her ex-husband’s house during their bitter divorce.

He’d been throwing away her mail for eight months. CaliClaw didn’t care about the drama. It had followed protocol.

How the Address Trap Works

CaliClaw only has to mail notices to your “last known address.”

- Moved since you filed your last return? Tough luck.

- Staying at your girlfriend’s place? Not their problem.

- Mail forwarding expired? CaliClaw doesn’t care.

- Landlord throwing away your mail? Still counts as “delivered.”

They sent the warnings to the apartment you lived in three years ago. Legally, you were warned. Practically, you’re ambushed.

The Victims I’ve Rescued

- Marcus*, whose notices went to his college dorm (he graduated two years ago)

- Jennifer*, who moved for a new job and forgot to update her FTB address

- David*, whose nightmare ex-girlfriend was intercepting his mail

(*All client names changed to protect privacy)

All of them swore they “never got a warning.” All of them were technically wrong.

The Double Trap

Here’s what makes this vicious: While you’re not getting the warnings, CaliClaw is building its legal case. Every “delivered” notice strengthens its right to take your money.

By the time you realize what’s happening, CaliClaw has months of “proof” that you ignored their warnings.

The 10-Day Death Clock: CaliClaw’s Bank Account Assassin

Forget wage garnishments that chip away at your paycheck over months. When CaliClaw targets your bank account, it moves like a financial assassin.

The Timeline of Terror

- Day 1: CaliClaw sends an “Order to Withhold” to your bank

- Days 1-10: Your account is frozen (you can’t access YOUR money)

- Day 11: CaliClaw drains everything

Ten days. That’s all you get.

The Real Horror Story

Last week, Miguel* called me on a Friday at 7 PM. CaliClaw had frozen his account with $4,200—money meant for his daughter’s medical procedure.

(*Client name changed to protect privacy)

“Carlos,” he said, voice shaking, “the surgery is scheduled for Monday. What do I do?”

The Weekend Nightmare

See, CaliClaw doesn’t care about your schedule. It froze Miguel’s account on a Friday, knowing he’d have no way to get help over the weekend.

His daughter needed surgery. The hospital needed payment. CaliClaw had taken hostages.

The Army Medic Protocol

That’s when my trauma training kicks in. Same protocol as an ambulance call: Stop the bleeding. Stabilize the patient. Save the life.

We filed emergency paperwork Saturday morning, documented the medical hardship, and got his account released Monday at 9 AM.

Miguel’s daughter got her surgery. CaliClaw found a different hunting ground.

Why the 10-Day Clock Is So Deadly

Most people don’t even realize their account is frozen until they try to use their debit card. By then, they might have 3-4 days left before everything disappears.

Rent due? Mortgage payment? Kids’ school fees? CaliClaw doesn’t negotiate. It just takes.

CaliClaw’s Ultimate Trap: Creating Debt from Nothing

This is CaliClaw’s most twisted tactic—and the one that catches the most people off guard.

The Phantom Income Nightmare

Three months ago, Janet* called me in tears. “Carlos, CaliClaw says I owe $8,400 for 2021. But I was unemployed all year. I didn’t make ANY money!”

(*Client name changed to protect privacy)

I pulled her transcripts. Sure enough—CaliClaw had created a “Substitute for Return” (SFR). They’d invented income she never earned and calculated taxes on money she never made.

How CaliClaw Creates Debt from Nothing

If you don’t file a California tax return, CaliClaw doesn’t just wait around. It plays God with your financial life:

- It estimates your income (usually way higher than reality)

- It files a return for you (with zero deductions, worst-case scenario)

- It calculates taxes on phantom income

- It starts the collection process for money you never owed

Janet was unemployed, living off savings. CaliClaw decided she made $45,000 and owed massive taxes on imaginary income.

More Phantom Income Victims

- Tom*: CaliClaw said he made $60K; he actually made $12K part-time

- Lisa*: Assigned $50K income during her cancer treatment (zero income year)

- Robert*: Given $75K for a year he was deployed overseas (military pay, not California taxable)

(*All client names changed to protect privacy)

All of them got wage garnishments for taxes they never owed on income they never made.

Why CaliClaw Does This

Simple: If you don’t file, you can’t argue. CaliClaw creates the worst-case scenario, knowing most people will just pay rather than fight.

It’s like being charged for a murder that never happened, but the “evidence” file is locked away where you can’t see it.

The Janet* Victory

We filed her actual 2021 return showing zero California income. Proved she was unemployed. Documented her situation.

(*Client name changed to protect privacy)

Result: $8,400 debt became $0 owed. CaliClaw’s phantom income vanished like the fiction it always was.

How to Defend Yourself Against CaliClaw

After fighting this beast for over a decade, here’s what I’ve learned:

Immediate Defense Strategies

- Update your address immediately with FTB if you’ve moved

- Check for existing notices on FTB’s website

- Don’t assume silence means safety—CaliClaw hunts quietly

- File all missing returns before CaliClaw creates phantom income

- Act fast if you receive any FTB notice—time is your enemy

Emergency Intervention Protocol

If CaliClaw has already struck:

- Don’t panic (panic clouds judgment)

- Document everything (hardship, address issues, income discrepancies)

- Get professional help immediately (CaliClaw doesn’t negotiate with amateurs)

- File emergency paperwork within the 10-day window for bank levies

The Specialized Knowledge Advantage

Fighting CaliClaw requires specialized knowledge most tax professionals don’t have. It’s like performing trauma surgery—you better know exactly what you’re doing, or the patient dies on the table.

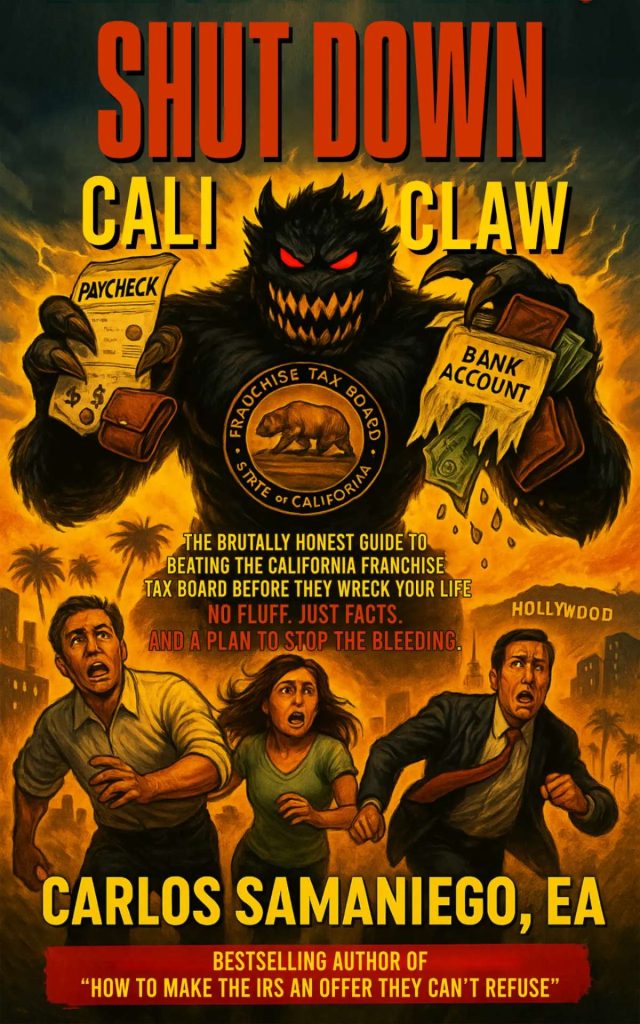

I spent years studying CaliClaw’s patterns. Wrote a 150-page manual called “Shut Down CaliClaw” because I was tired of watching families get mauled while “tax experts” shrugged their shoulders.

Why I Fight CaliClaw

As a former Army Psychiatric Technician and EMT, I was trained to save lives in ambulances. Now I rescue families from financial predators.

The principles are the same:

- Triage the crisis (stop the bleeding)

- Stabilize the patient (prevent further damage)

- Systematic recovery (long-term healing)

Every client who calls me crying about CaliClaw reminds me why this work matters. It’s not just about taxes—it’s about preserving families, protecting dignity, and giving people hope when they feel completely trapped.

The Bottom Line

CaliClaw is more dangerous than most people realize. It’s methodical, ruthless, and designed to take your money before you can mount a defense.

But here’s what CaliClaw fears: A trauma-trained tax professional who knows its weaknesses. Someone who’s fought it hundreds of times and won. Someone who treats your financial emergency like the life-threatening crisis it actually is.

Don’t be CaliClaw’s next victim. If you owe California taxes—or think you might—don’t wait until you’re explaining to your family why there’s no money for groceries.

The time to act is now, before CaliClaw completes its kill sequence.

Carlos Samaniego, EA, is The Tax Debt Detective™ and co-founder of Tax Debt Consultant LLC. A former U.S. Army Psychiatric Technician and EMT with over 30 years of crisis intervention experience, Carlos specializes in rescuing families from what he calls “The Tax Underworld.” He has been featured on NBC, CBS, ABC, and PBS, and is the author of four books including “Shut Down CaliClaw” and the Amazon bestseller “Never Give Up!” co-authored with ESPN legend Dick Vitale.

Need immediate help with CaliClaw? Call 909-570-1103 (24/7) or visit CallTaxEA.com

Don’t let CaliClaw hunt alone. It’s stronger than you think—but it’s not stronger than specialized knowledge and three decades of crisis intervention experience.